Southeast Asia is one of the world’s fastest-growing markets—and one of the least well known.

RELATED POST

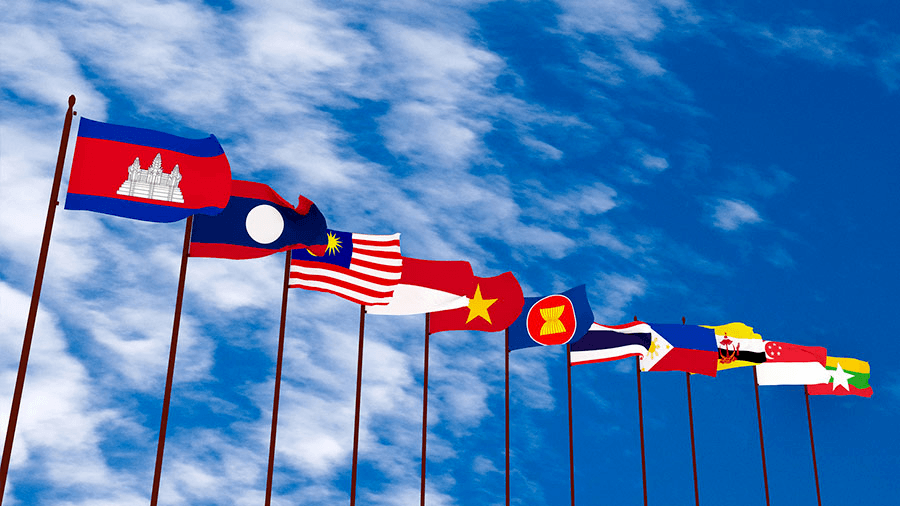

ASEAN is a major global hub of manufacturing and trade, as well as one of the fastest-growing consumer markets in the world.

As the region seeks to deepen its ties and capture an even greater share of global trade, its economic profile is rising—and it is crucial for those outside the region to understand its complexities and contradictions.

The seven insights below offer a snapshot of one of the world’s most diverse, fast-moving, and competitive regions.

1. ASEAN’s ten member states combined is an economic powerhouse.

If ASEAN were a single country, it would already be the seventh-largest economy in the world, with a combined GDP of $2.4 trillion in 2018.

It is projected to rank as the fourth-largest economy by 2050. In fact,

In fact, ASEAN is one of the largest economic zones in the world with rapid and relatively stable growth since 2000.

Labor-force expansion and productivity improvements drive GDP growth—and ASEAN is making impressive strides in both areas.

Home to more than 600 million people, it has a larger population than the European Union or North America.

ASEAN has the third-largest labor force in the world, behind China and India; its youthful population is producing a demographic dividend.

Perhaps most important, almost 60% of total growth since 1990 has come from productivity gains, as sectors such as manufacturing, retail, telecommunications, and transportation grow more efficient.

2. ASEAN is not a monolithic (singular) market.

ASEAN is a diverse group.Indonesia represents almost 40% of the region’s economic output and is a member of the G20.

While Myanmar, emerging from decades of isolation, is still a frontier market working to build its institutions.

GDP per capita in Singapore, for instance, is more than 50 times higher than in Cambodia and Myanmar.

In fact, it even surpasses that of mature economies such as Canada and the United States.

The standard deviation in average incomes among ASEAN countries is more than 7X that of EU member states.

That diversity extends to culture, language, and religion.

Indonesia, for example, is almost 90% Muslim, while the Philippines is more than 80% Roman Catholic, and Thailand is more than 95% Buddhist.

Although ASEAN is becoming more integrated, investors should be aware of local preferences and cultural sensitivities.

They cannot rely on a one-size-fits-all strategy across such widely varying markets.

3. Macroeconomic stability has provided a platform for growth.

Memories of the 1997 Asian financial crisis linger, leading many outsiders to expect that volatility comes with the territory.

But the region proved to be remarkably resilient in the aftermath of the 2008 global financial crisis, and today it is in a much stronger fiscal position.

Overall government debt is under 50% of GDP—far lower than the 90% share in the United Kingdom or 105% in the United States.

Most of the region has held steady so far, despite concern about the effect on emerging markets.

In fact, ASEAN has experienced much lower volatility in economic growth since 2000 than the European Union.

Savings levels have also remained fairly steady since 2005, at about a third of GDP, albeit with large differences between high-saving economies, such as Brunei, Malaysia, and Singapore, and low-saving economies, such as Cambodia, Laos, and the Philippines.

4. ASEAN is a growing hub of consumer demand.

67 million households in ASEAN states are part of the “consuming class,” with incomes exceeding the level at which they can begin to make significant discretionary purchases.

That number could almost double to 125 million households by 2025, making ASEAN a pivotal consumer market of the future.

There is no typical ASEAN consumer, but some broad trends have emerged: a greater focus on leisure activities, a growing preference for modern retail formats, and increasing brand awareness

Indonesian consumers, for example, are exceptionally loyal to their favorite brands.

The number of consuming households in ASEAN is expected to almost double by 2050.

5. Urbanization in ASEAN’s cities are booming.

Today, 22% of ASEAN population lives in cities of more than 200,000 inhabitants—and these urban areas account for more than 54% of the region’s GDP.

An additional 54 million people are expected to move to cities by 2025.

Interestingly, the region’s midsize cities have outpaced its megacities in economic growth.

Nearly 40 percent of ASEAN’s GDP growth through 2025 is expected to come from 142 cities with populations between 200,000 and 5 million.

6. High Internet penetration

ASEAN consumers are increasingly moving online, with mobile penetration of 110% and Internet penetration of 25% across the region.

Its member states make up the world’s second-largest community of Facebook users, behind only the United States.

But there are vast differences in adoption.

Hyperconnected Singapore has the fourth-highest smartphone penetration in the world, and almost 75 percent of its population is online. By contrast, only 1% of Myanmar has access to the Internet.

Indonesia, with the world’s fourth-largest population, is rapidly becoming a digital nation; it already has 282 million mobile subscriptions and is expected to have 100 million Internet users by 2016.

7. ASEAN is well positioned in global trade flows.

ASEAN is the fourth-largest exporting region in the world, trailing only the European Union, North America, and China/Hong Kong.

It accounts for 7% of global exports—and as its member states have developed more sophisticated manufacturing capabilities, their exports have diversified.

Vietnam specializes in textiles and apparel, while Singapore and Malaysia are leading exporters of electronics.

Thailand has joined the ranks of leading vehicle and automotive-parts exporters.

Other ASEAN members have built export industries around natural resources.

Indonesia is the world’s largest producer and exporter of palm oil, the largest exporter of coal, and the second-largest producer of cocoa and tin.

While Myanmar is just beginning to open its economy, it has large reserves of oil, gas, and precious minerals.

In addition to exporting manufactured and agricultural products, the Philippines has established a thriving business-process-outsourcing industry. China, a competitor, has become a customer.

In fact, it is now the most important export market for Malaysia and Singapore. But demand from the United States, Europe, and Japan continues to propel growth.

ASEAN Market is the Future of Global Income.

Despite their distinct cultures, histories, and languages, the ten member states of ASEAN share a focus on jobs and prosperity.

Household purchasing power is rising, transforming the region into the next frontier of consumer growth.

Maintaining the current trajectory will require enormous investment in infrastructure and human-capital development.

A challenge for any emerging region but a necessary step toward ASEAN’s goal of becoming globally competitive in a wide range of industries.

The ASEAN Economic Community offers an opportunity to create a seamless regional market and production base.

If its implementation is successful, ASEAN could prove to be a case in which the whole actually does exceed the sum of its parts.