The advantages of refinancing loan are many such as obtain lower interest rate compare to existing one, shorten the loan tenure, debt consolidation, switching to a better mortgage product, purchase another new property, get the additional cash out to renovate or improve your property, wedding funds, children education funds in the future and etc. Yes,I didn’t lie to you, it is true!

Believe most of the property investors out there are not strange with refinance, as the’re often use the cash out funds to renovate the investment property in order to get a significant profits from re-sell the property. While, refinancing loan can help homeowners to reduce their financial burden and pay-off the outstanding amount of personal loan or credit cards to turn their credit history to positive.

Apart from that, we heard there is a misconception on the cash out from a refinancing loan. In today, we will clear up your doubts about this common misconceptions. Here we goes;

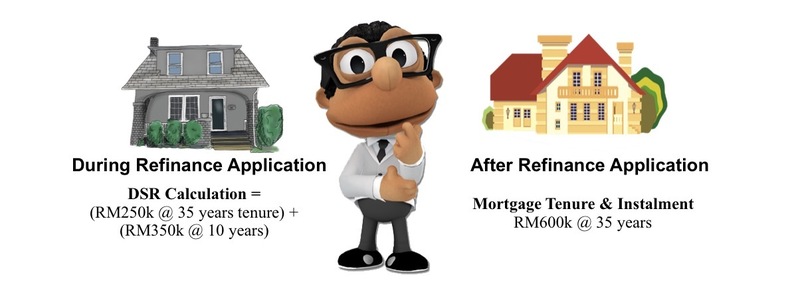

➧ The debt service ratio (generally known as DSR) of the additional cash out portion of your newly refinanced loan application will be calculated based on a 10 years repayment period of time.

➧ The additional cash out portion is used to pay-off your current outstanding balance of mortgage and the loan tenure is still the same as normal one which is up to 35 years.

➧ However, the above is just the calculation of your affordability or DSR. Its no collide with your actual refinanced mortgaged tenure. This is illustrated below:

For example, let say Michelle has an existing mortgage of RM 250k outstanding amounts and refinance property with the current market value of RM 600k mortgage application. Then, the cash out amount, though your bank officer informs you that they will reckon your repayment capacity based on 10 years tenure, its no collide with your actual mortgage tenure and the most importantly is your monthly mortgage installments. It is to ensure you have strong repayment capacity.