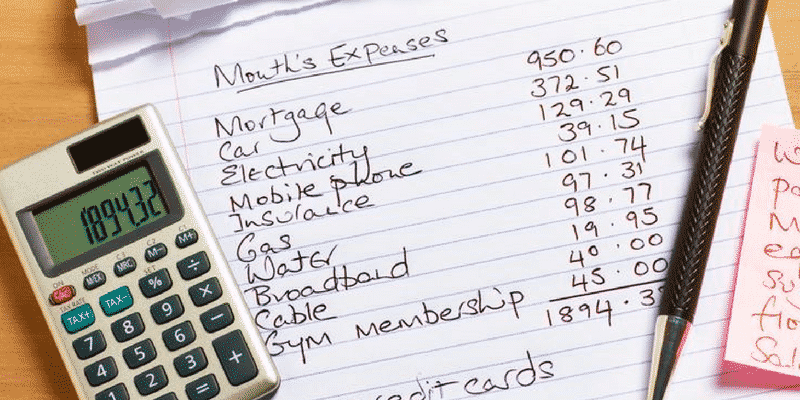

Budgeting is the core of personal finance.

Done right, it’s the most powerful system to bring people to financial security. Yet, many people have trouble creating budgets and sticking to them.

So, here’s the ultimate guide to monthly budgeting.

1. Automate the most important things

Most of could never save any money. Why?

Because we planned to save at the end of every month. Of course, by the time the month got to the end — there was nothing left.

So, force yourself to save/invest immediately when your salary arrived.

For investments, savings and loan repayments have these automatically deducted from your salary.

Set up a standing instruction with your bank to automatically do this every month on the day after you receive your salary.

Take the money away from your only-human self and put it somewhere good — before you do something silly with it.

2. . Monitor all your spending (for a while)

Tracking your spending is not a huge burden as there so many apps to help you with that.

Just take 30 seconds of your time and log in every time you spend money on food, bills and anything.

Once you do it, you’ll probably end up frightened by how you’re spending your money.

It’s a good kind of fear. The type that makes you reevaluate priorities like : “Do I really wanna be spending 10% of my salary on coffee?

Just try it out for a few months — you’ll be amazed at what you find out.

3. Reduce Temptation

Most of us want comfortable lives with luxuries. But not many of us have enough willpower to withstand temptation.

When you keep watching advertisements and promotions — you end up feeling like you need to buy something.

So take a good, honest look at yourself. Check your money app to see where you’re spending most of your money — your “weakness.”

If you’re spending too much on drinking, the solution is to try ordering cheaper bottles.

But your weakness could be anything else like bedding section at Ikea or maybe it’s AirAsia’s Flash Sales.

Whatever it is, if it’s f*cking up your budget — stay far away from it.

A final Note on Income!

It gets easier to budget when you earn a lot but low-income workers will always struggle.

For example, if you’re earning RM8,000 a month and finding it hard to stick to a budget, your problem is more likely motivation and discipline.

But no matter how mentally strong a person is, it’s gonna be crazy difficult to stick to a monthly budget of RM1,000 and try to feed a family.

Makes sense? So as much as budgeting is important, it’s only one side of the equation.

Put simply, the path to financial stability consists of this: making money and keeping the money.

Budgeting will help you with keeping the money. But if your income is low, you’ll also need to figure out how to make more money.